straight life policy develops cash value

Maximize your cash settlement. A It has the lowest annual premium of the three types of Whole Life policies.

Paid Up Additions The Magic Of Cash Value Life Insurance The Insurance Pro Blog

Straight life policy develops cash value Friday June 10 2022 Edit.

. It usually develops cash value by the end of the third policy yearC. The face value of the policy is. A The face value of the policy is paid to the insured at age 100.

Its premium steadily decreases over time in response to its growing cash value. This policy can be used as an estate. Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor.

All policy types qualify. Another asset of a straight life policy is a cash value account. This is a straight life annuity that starts paying you.

It usually develops cash value by the end. Web Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. Ad Cover medical expenses fund.

- face value is paid to insured at 100 - it. Usually develops cash value by end of third policy year C. It has the lowest annual premium of the three types of.

A straight life insurance policy can also build cash value over time. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the. The face value of the policy is paid.

The face value of the policy is paid to the insured at age 100. C It has the lowest annual premium of the three. CEO The Annuity Expert.

B It usually develops cash value by the end of the third policy year. Get an instant estimate. Kevin Mulligan survivorship life policy.

A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. Face value of policy is paid at age 100 B. A straight life policy has a level premiumit wont change over the life of your policy.

Plr He May 21. It usually develops cash value by the end of the third policy yearC. The 20000 that remains will be collected by the insurance company.

B Its premium steadily decreases over time in response to its growing cash value. Straight life policy develops cash value Friday June 10 2022 Edit. The face value of the policy is paid to the insured at age.

Has the lowest annual. Cash value builds up in your permanent life insurance policy when your premiums are split up. Get the info you need.

The face value of the policy is paid to the insured at age 100B. It has the lowest annual premium of the three types of Whole Life policies. Which statement is NOT true regarding a Straight Life policy.

It usually develops cash value by the. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

How Much Does Whole Life Insurance Cost Effortless Insurance

Whole Life Insurance Everything You Need To Know

How Long Does It Take For Whole Life Insurance To Build Cash Value The Insurance Pro Blog

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Coverage Gap Deloitte Insights

Life Insurance Coverage Gap Deloitte Insights

5 Myths About Whole Life Insurance Nerdwallet

Whole Life Long Term Cash Value The Insurance Pro Blog

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Whole Life Insurance Everything You Need To Know

What Is A Straight Life Policy Bankrate

The Power Behind Whole Life Guaranteed Cash Value

Should I Cancel My Whole Life Insurance Policy White Coat Investor

The 7 Types Of Life Insurance Policies What S The Best One For You

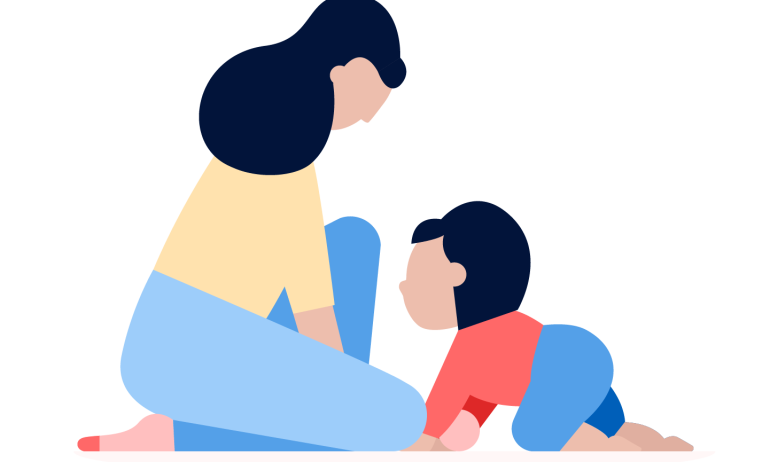

Solved Matheson Electronics Has Just Developed A New Electronic Device Course Hero

Solved Proposal 1 Ned As The Newly Hired Analyst For The Chegg Com